How solar repowering can reach its potential

Quitting Carbon checked in with two researchers at the National Renewable Energy Laboratory who are investigating the potential of the solar repowering market in the U.S.

Quitting Carbon is a 100% subscriber-funded publication. To support my work, please consider becoming a paid subscriber or making a one-time donation.

I published a story in May asking if it is time to repower the first wave of large solar projects?

In the wind power industry, repowering is already commonplace.

“Confronted with aging equipment but convinced that their investment can continue to make a profit, project owners decide either to replace components on individual turbines such as the blades, gearboxes, and hubs, or to replace the site’s turbines entirely with new more powerful models,” I wrote. “Repowering can present project owners with a win-win opportunity: more power on the same footprint with fewer turbines, using an existing connection to the grid.”

I have been curious to learn whether the same dynamics that have turned wind repowering into a mature business are beginning to appear in the solar industry, too.

In my earlier story, I mentioned that a team of researchers at the National Renewable Energy Laboratory (NREL) was busy looking into the solar repowering market in the U.S. I recently spoke with two of those researchers, Heather Mirletz and Silvana Ovaitt, to get an update on their work.

“Repowering is a nascent practice in PV, with more questions than answers regarding how much and to what extent it is happening,” Mirletz and Ovaitt wrote with their colleagues Brian Mirletz and Matthew Prilliman in a paper presented at a technical conference in Montreal in June.

“At the utility scale in the U.S., repowering remains uncommon due to significant economic and logistical barriers,” they added. “While there is growing interest, repowering is often prohibitively expensive, with most cases driven by reliability issues such as failures of inverters, backsheets, and trackers.”

I spoke with Mirletz and Ovaitt about some of those barriers and also about opportunities such as the potential to install battery energy storage systems when repowering solar projects.

This conversation has been edited for length and clarity.

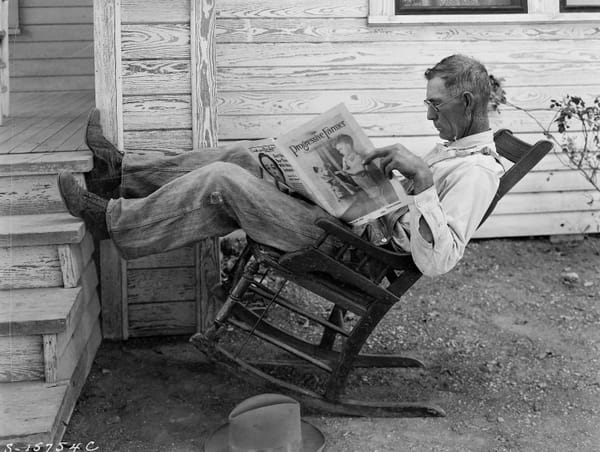

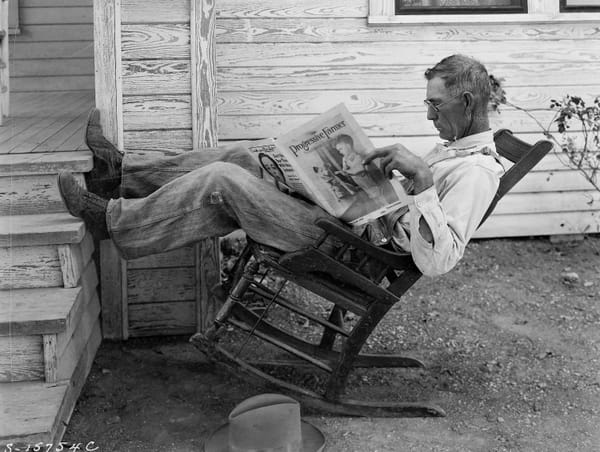

NREL solar PV researchers Heather Mirletz (left/above) and Silvana Ovaitt (right/below). Credit: NREL.

Based on the industry experts you talked to, you estimated that solar repowering projects cost 10% to 30% more than greenfield projects. Does a similar price premium exist for wind repowering projects?

Heather Mirletz: Wind had a very clear business case where there's only certain sites that have a really nice wind resource. And their efficiency increases were essentially an order of magnitude more than the efficiency increases we are seeing in PV. We're continuing to get better at making more efficient modules, but it's not that same orders of magnitude jump. It's incremental.

There are the re-engineering costs. Like, We want to keep the racking, we want to keep the electrical balance of systems and all the cabling. But that's very hard to do, and that requires a lot more engineering time to figure out the fiddly little details. It makes every project a special snowflake to the point it takes a prohibitive amount of time for engineering. You're essentially doing a decommissioning, plus a new system, which is where that extra cost comes into it.

For sites in places like Europe, repowering is happening a little bit more. There's very specific sites and some of the other economics play into it a little bit differently there than it does here. As opposed to: There's plenty of land out here in the West, let's just go build a solid farm. You don't necessarily have that in Europe; there's fewer sites. Repowering there does make more sense because there's that restriction.

I was going to ask about the European market. It makes sense that repowering would have started there first because the utility-scale sector started earlier in markets like Spain and Germany than it did in the U.S. You mentioned the land constraints – there's just not as much land to build new projects in Europe. But there are also economic drivers. Projects in Germany are coming off their 20-year feed-in tariffs. Is that a factor as well?

Heather Mirletz: That would definitely be factoring into it. We haven’t studied that in detail yet, so I can't tell you exactly how, but those are all definitely relevant factors. The feed-in tariffs have a huge impact on the economics, versus the merchant tail, where once you finish paying off the loan, and once you're done with your PPA, it's all just like bonus energy here in the U.S.

One of the key takeaways from your new research is that at least at this point in the U.S., reliability has been driving repowering, not economics. It has been equipment failures and repairs. You also refer to, in residential and commercial settings, external factors like re-roofing or remodeling a building or a building demolition.

Heather Mirletz: Yes, for the most part, it is reliability driven. Inverter failure is a common one across all the different sectors, residential all the way up to utility-scale. Residential and commercial can have other external factors, such as the roof or a change in lease of, say, a Walgreens. A change in lease can sometimes trigger a renegotiation of terms, and sometimes that will end up with a repower, sometimes that'll end up with decommissioning the system prematurely, just because it might blow up the lease agreement.

We were also hearing of residential installers being like, Hey, you can have a bigger system, and you can get the ITC [federal Investment Tax Credit] if you do it now.

People have increasing needs if they're electrifying their home. It's a restricted amount of roof space for a residential system, and so the efficiency matters more. At utility-scale, it's pretty much all reliability – the inverters or trackers or the module itself is triggering the “Should we repower?” question.

Getting back to that cost premium of 10% to 30% for repowering compared to a greenfield project – which comes in at between $1 and $2.50 a watt. Do you expect those numbers to go down in the coming years?

Silvana Ovaitt: That's a good question. One way that they can come down is if the new solar fields go up. There's definitely a desire from people who are doing this to facilitate things like the interconnection permit waits. If it makes the interconnection negotiation easier or nonexistent, that will definitely bring down those numbers. Some of the cost is also just inactivity, waiting for things to be able to proceed forward. If the interconnection permit goes towards the path of making it easier, that will improve the economics. There's also talk from manufacturers on perhaps establishing a standard module size.

That could be very helpful.

Heather Mirletz: Another one might be if robotics gets to the point where it can be used to assemble fields. That would change the labor costs significantly, which is a large portion of the decommissioning and of the greenfield projects. If the robot is "slinging glass" – the term in the field – instead of humans, that might bring the cost down, but that's when the robots are ready, which I don't know when that's going to be.

Silvana makes a really good point about interconnection, and that's something we're going to be looking at hopefully coming up here shortly, especially the utility-scale, the value of having a grid connection and a transformer. All of that may be increasing significantly because it has been relatively simple to say, I'll just go down the road and build a new one.

That's a good segue to my next topic. Your research refers to the significant economic and logistical barriers, especially in the utility-scale space, for solar repowering. But there is also intense pressure to add new capacity to the grid to meet the expected increased electricity demand from AI and new data centers.

It seems to make a lot of sense to add more capacity at large solar farms that have existing grid connections. But you also cite factors at work there – interconnection costs and permitting. If you have existing interconnection rights, it should be easier, right? You should be able to add capacity at the same site, unless you're adding more than you had agreed to at the outset with the off-taker and the grid operator?

Heather Mirletz: That's the key – if you are adding more. Our understanding is that in California you can have a plus 10% to whatever your grid interconnect is. And usually, if you were going to repower an entire site, you're going to be significantly more than 10%. That brings us to another future work item that we're hoping to do, which is: Okay, but if you put a battery there, then you could repower and use the same site. And let's store that and feed it out at different hours of time.

Take California as an example. If you were to exceed that 10% capacity increase you mentioned, would the project developer lose its place in the interconnection queue and have to start over? Would you have to re-enter the queue with other projects, even though you have an existing site and interconnection agreement?

Heather Mirletz: That is our understanding. That is a major barrier for a lot of the utility-scale projects. They're like, You don't want to deal with that. That's a whole lot of money that they're leaving on the table.

Silvana Ovaitt: Owners and plant managers try to do as much as they can under the flag of “repair” because that does not trigger most permits. If it can just be a one-to-one module swap, that will not require any other permits. But if you start doing more building or adding more capacity, you start to get into that permit area, which then adds to the difficulty.

Heather Mirletz: Say, an inverter fails. It's a very classic failure. There's a lot of troubles with replacing the inverter, because the modules are continuing to change and evolve with time. You might have a massive voltage management issue with your system, and you can't get a new inverter at the voltage of your original system, or they just aren't replacing parts.

We've heard there's a lot of proprietary parts and software that they just don't want you tinkering around in there. Then there's the module itself, the backsheet. That's one more really good trigger, especially if you get into warranty claims. It can drag on trying to figure out who's responsible for what aspects of it, and whether it could be repaired in place with a covering.

Trackers is also a big issue. The classic one we hear about is the two-axis tracker goes non-functional. The other really big one is because the modules have been getting bigger, they don't fit the same on trackers. Some of the trackers you can, as Silvana will attest, move the racking system, and others you can't. And some of the tracker companies are willing to work with you, and some of them aren't.

Then there's all the contracts Silvana was talking about. Those long interconnection queues you might get bumped to the back of it, the re-engineering costs, everybody's time to figure out all those fiddly details and the grid interconnection of whether you're allowed to expand beyond that 10%.

One of the other ones we were hearing was: You don't want to piss off your landowner. If you have a land lease agreement, you have a vested interest in maintaining a good relationship with them. If you were to come to them and say, "I don't need half of this land, I'm going to only pay you half what I was before," that's bad blood right there. We want that social license to operate. That's really important. You're breaking a contract.

And then there is the tax credits, the ITC. Previously, it has been the same as the wind rule. If you have 80% new material, then you qualify for the ITC credit. There's a balancing of how much you replace; you replace it, you get the ITC credit. But it costs more to replace more of the system, and if you're digging up cabling, that's a lot of money and time and effort. The balance of that frequently does not work out at the utility-scale.

I wanted to quickly return to storage. Here in California, a lot of big, early utility-scale solar projects do not have storage. Might that be a driver for repowering? Project owners could see the value in adding several hundred megawatts of storage to their project. You could reduce curtailment and provide more flexibility to the grid with batteries – even if you increased the nameplate capacity of the solar farm.

Heather Mirletz: You have touched upon the thing that we are pitching right now to get funded to go research. You hit the nail on the head. That is 100% something I think will change the economics of it. We don't know how yet; it is entirely probable that that would help. It also might be cost prohibitive. We're not sure yet.

You touched on the federal tax credit changes with the passage of the One Big Beautiful Bill and its earlier phaseout of the Inflation Reduction Act’s tax credits for solar and wind power. Have you started to think about what the implications could be for solar repowering?

Heather Mirletz: The first one that occurred to us – again, we have not actually done this work yet – is that batteries did not get their tax credit cut, and so that might lend itself to hybridization, which is part of why we're so interested in looking into the battery-repowering confluence. Similarly, if you can't get the modules to build and you can't get the permits to build a new site, then the value of that interconnection point becomes significantly more valuable.

Regarding the commercial solar sector, your research found that it's very dependent on utility costs and the location. What are the implications for solar repowering in markets like California, Hawaii, and New England with electricity rates that are double or more the national average?

Heather Mirletz: Those areas potentially have a higher probability of doing repowering. Because of that, we are working on building tools so people can do an evaluation. With this project, and one that's still underway, we're trying to plug that into software. Eventually, there will be a tool where people could input their utility rates, input their estimates for what a new system would cost, and what it cost to decommission, based on local labor rates.

Our findings are that if your utility rates are higher, then it is more likely that the system would pay back sooner. It will give you a higher net present value, which are the metrics that we're hearing from industry are important to them.