Is it time to repower the first wave of large solar projects?

Repowering is well established in the onshore wind business. Is it time to repower solar projects, too?

Quitting Carbon is a 100% subscriber-funded publication. To support my work, please consider becoming a paid subscriber or making a one-time donation.

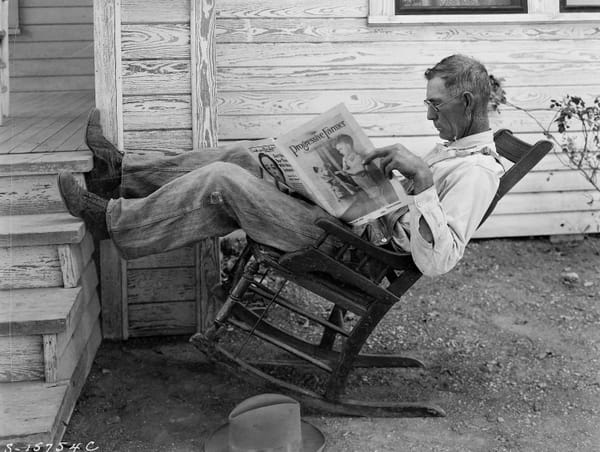

Solar is undergoing a hockey-stick growth spurt.

Global solar deployment hit a record 597 gigawatts (GW) last year – a 33% increase over 2023, according to a new SolarPower Europe report.

The past three years have seen especially rapid growth, but there is a long tail to the industry, with large-scale solar deployments starting to gain momentum around 2010. Long enough ago that key equipment for legacy utility-scale projects – especially inverters – is reaching the end of its useful life.

Is it time for the owners of these projects to borrow a page from the onshore wind industry’s playbook and consider repowering their assets?

Time to repower?

On the May 2 episode of Latitude Media’s “Open Circuit” podcast, guest Michael Cembalest, chair of the market and investment strategy group for J.P. Morgan Asset and Wealth Management, was asked by co-host Stephen Lacey “how equipment shortages and rising costs are playing into the development of both renewables, storage, and gas.”

“If the administration, when they claim that they’re [primarily] focused on excess consumption and they’re trying to not mess up intermediate business and supply chains, I don’t see any evidence of that because I see plenty of tariffs and other kinds of costs for the exact kind of capital goods that feed into the energy infrastructure,” replied Cembalest.

Co-host Jigar Shah, the former director of the U.S. Department of Energy’s Loan Programs Office and founder of the pioneering solar energy company SunEdison, replied that President Trump’s tariffs could provide extra incentive for asset owners to repower their aging solar projects.

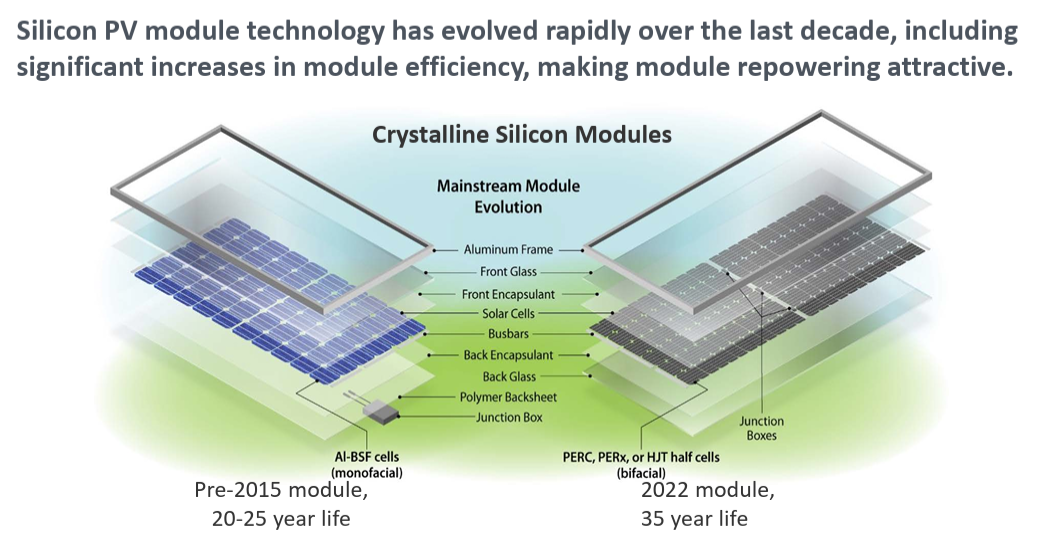

“One of the arbitrages that I think is going to be fascinating over the next six years because of what you just said on the trade tariff piece is, I think, you’re going to find that Brookfield [Renewable U.S.] and NextEra [Energy Resources] are going to find that the most profitable thing for them to do is actually just repower their old solar sites that have 13% efficiency panels with 23% efficiency panels. Add four to five hours of battery storage and use the exact same interconnection point, but double the capacity factor from 25% to 50%."

What Shah referenced – “repowering” – is now commonplace in the onshore wind industry.

Confronted with aging equipment but convinced that their investment can continue to make a profit, project owners decide either to replace components on individual turbines such as the blades, gearboxes, and hubs, or to replace the site’s turbines entirely with new more powerful models. Repowering can present project owners with a win-win opportunity: more power on the same footprint with fewer turbines, using an existing connection to the grid.

Onshore wind repowering is already a gigawatt-scale business in the U.S.

“To date, approximately 7 GW of onshore wind capacity has been fully repowered in the U.S., according to Wood Mackenzie, while an additional 12 GW has been partially repowered,” CNBC’s Bob Woods reported last month.

Solar repowering poised for a boom

What could this look like for the solar industry?

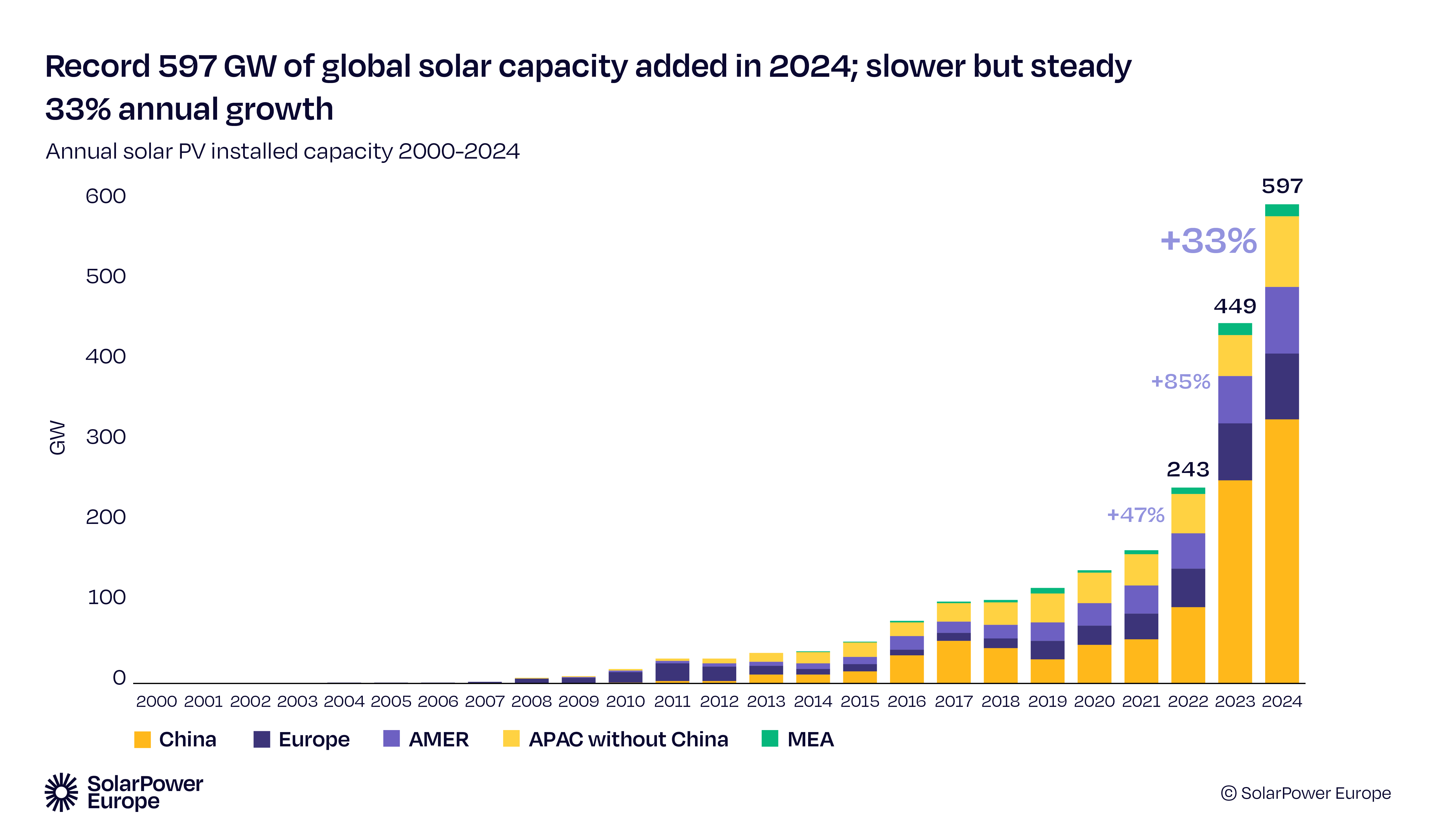

“Many PV projects are undergoing the need for replacing components, especially given the greater efficiency of newer solar panels and the fact that inverters (which have an average normal useful life of 15 years) are in need of replacement,” a team at accounting and consulting firm CohnReznick wrote last year.

For a frame of reference on the micro scale, think of the solar PV system you might have installed on your own roof.

Three years ago, after almost exactly 15 years, the original inverter died for the rooftop solar PV system that came installed with my home. I swapped that 1.8-kilowatt (kW) system for a new 10-panel, 4.25-kW system outfitted with microinverters attached to each panel.

Now imagine this same scenario but scaled up to include the large utility-scale solar projects built 15 years or longer ago.

“According to projections by Wood Mackenzie, approximately 23 GW of U.S. solar – across residential, commercial, and utility scales – will approach this 15-year benchmark within the next five years. This means an average of 4.5 GW of PV projects will need new inverters every year until 2030. Meanwhile, the PV panels and balance of plant have various useful lives with an average of 35 years,” wrote the CohnReznick team.

One of the primary benefits of repowering is that the project owner has already secured an interconnection agreement with the grid operator. For new-build greenfield projects, permission to connect to the grid often requires a years-long wait.

As of January 1 of this year, interconnection times for new energy projects range from 3.8 years in New England to 9.2 years in California, according to the analytics company Enverus.

The path forward

Despite the significant potential, the near-term outlook for solar repowering is somewhat uncertain. Much depends on the fate of the Inflation Reduction Act’s federal clean energy tax credits as Republicans in Congress debate what provisions to include in their final budget reconciliation package in the coming weeks. And then there is the great unknown of what Trump will decide on any given day regarding the tariffs assessed against products, sectors, or countries.

Meanwhile, researchers at the U.S. Department of Energy’s National Renewable Energy Laboratory (NREL) have been busy assessing the potential market.

“Repowering often costs 80% of the total plant value. A repowered PV system is new in almost all respects and can leverage existing land-use, permitting, utility interconnections, and power purchase prices,” according to an analysis by a team of NREL researchers published in 2021.

Another NREL team is now undertaking a study – scheduled to run through July of this year – to quantify the impact of PV system repowering on project economics, sustainability, and equity.

In a presentation delivered for a webinar hosted by DOE’s Solar Energy Technologies Office last October, the research team shared insights gleaned from interviews with industry experts.

“Interviewees have only seen repowering due to failures, to avoid violating contract agreements/PPAs,” wrote the researchers. “Otherwise, economically it hasn’t yet made sense, but owners have been actively looking for evaluations.”

The researchers also cited potential barriers for solar repowering projects such as high re-engineering costs compared to greenfield projects, permitting hurdles, and required equipment upgrades, including “racking with changing module sizes, electrical changes that require recabling for higher power modules, and inverter changes to go from 600V to 1000V.”